Exploring the world of Electric vehicle insurance and tech integration, this guide delves into the importance of insurance for electric vehicles and how technology is revolutionizing the insurance industry. From discussing key factors influencing insurance rates to predicting future trends, this guide covers it all.

Overview of Electric Vehicle Insurance

Electric vehicle insurance is crucial for protecting your investment and ensuring financial security in case of accidents or damages. Just like traditional vehicles, electric cars require insurance coverage to comply with legal requirements and safeguard against unexpected events.

Importance of Insurance for Electric Vehicles

Insurance for electric vehicles is essential to cover the costs of repairs, replacements, or medical expenses in case of accidents. It provides peace of mind and financial protection, especially considering the high initial cost and specialized components of electric cars.

Comparison of Insurance Coverage

Insurance coverage for electric vehicles may differ from traditional vehicles due to unique factors such as battery replacement costs, repair procedures, and specialized technicians. While basic coverage remains similar, additional considerations are taken into account for electric cars.

Factors Influencing Insurance Rates

Several key factors influence electric vehicle insurance rates, including the model and make of the car, driving history, location, mileage, safety features, and battery type. Insurers assess these elements to determine the level of risk and potential costs associated with insuring an electric vehicle.

Integration of Technology in Electric Vehicle Insurance

Technology plays a crucial role in the integration of electric vehicle insurance policies, offering innovative solutions to manage risks and streamline claim processes efficiently.

Tech Tools for Risk Assessment

- Telematics Devices: These devices collect data on driving behavior, such as speed, mileage, and braking patterns, to assess risk accurately.

- AI and Machine Learning Algorithms: These tools analyze vast amounts of data to predict potential risks and determine personalized insurance premiums based on individual driving habits.

- Data Analytics Platforms: These platforms help insurance companies identify trends, patterns, and outliers in driving data to make informed decisions on risk assessment.

Benefits of Using Technology in Insurance Claims

- Efficient Claims Processing: Technology enables faster and automated claims processing, reducing the time taken to settle claims and enhancing customer satisfaction.

- Accurate Risk Assessment: By leveraging data analytics and telematics, insurance companies can assess risks more accurately, leading to fairer premiums for policyholders.

- Improved Customer Experience: Technology integration allows for seamless communication between insurers and policyholders, offering real-time updates on claims status and enhancing overall customer experience.

Telematics and Electric Vehicle Insurance

Telematics devices play a crucial role in the realm of electric vehicle insurance, offering a more personalized and data-driven approach to coverage. These devices, when integrated into electric vehicles, collect various data points related to driving behavior, vehicle usage, and performance.

Role of Telematics in Electric Vehicle Insurance

Telematics devices in electric vehicles gather real-time data on factors such as speed, acceleration, braking patterns, and mileage. This data is then analyzed by insurance companies to assess the risk profile of individual drivers. By utilizing telematics data, insurance providers can offer more accurate and tailored insurance premiums based on actual driving habits rather than general assumptions.

- Telematics devices help insurance companies determine insurance premiums by rewarding safe driving behaviors. Drivers who exhibit responsible driving practices, such as maintaining a steady speed and avoiding sudden accelerations or harsh braking, may be eligible for discounts on their premiums.

- On the other hand, drivers with risky driving habits may face higher insurance costs due to the increased likelihood of accidents. Telematics data allows insurers to incentivize safer driving behavior and encourage policyholders to drive more cautiously.

Privacy Concerns in Telematics Data

Telematics devices raise concerns about the privacy of drivers' data, as these devices continuously monitor and collect information about driving habits. While this data is primarily used for determining insurance premiums, there is a risk of potential misuse or unauthorized access to sensitive information.

It is essential for insurance companies to ensure the secure handling and protection of telematics data to safeguard the privacy of policyholders.

- Some drivers may be hesitant to adopt telematics devices due to fears of their data being shared with third parties or used for purposes beyond insurance premium calculations. Insurance providers must be transparent about how telematics data is utilized and stored to alleviate these concerns.

- Implementing robust data security measures and obtaining explicit consent from policyholders for data collection and usage are crucial steps in addressing privacy issues associated with telematics in electric vehicle insurance.

Future Trends in Electric Vehicle Insurance and Tech Integration

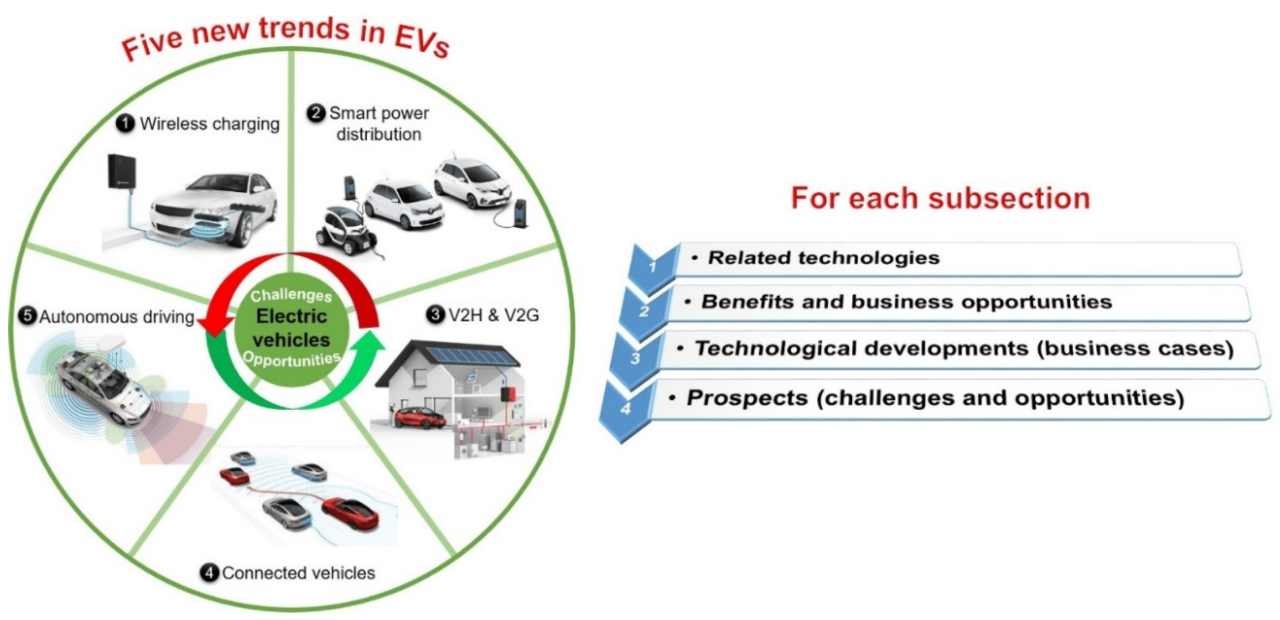

As technology continues to advance at a rapid pace, the landscape of electric vehicle insurance is poised for significant changes. These advancements will not only impact how insurance policies are priced and structured but also how insurers interact with policyholders.

Let's explore some potential future trends in electric vehicle insurance and tech integration.

Advancements in Technology Impacting Electric Vehicle Insurance

- Integration of AI and Machine Learning: With the use of artificial intelligence and machine learning algorithms, insurance companies can analyze vast amounts of data to assess risk more accurately. This can lead to personalized insurance policies based on individual driving habits and vehicle usage.

- Blockchain Technology: Blockchain can streamline the claims process by providing a secure and transparent way to record transactions. This can reduce fraud and improve the efficiency of claims processing for electric vehicle owners.

- Connected Vehicles and IoT: The rise of connected vehicles and the Internet of Things (IoT) will enable insurers to gather real-time data on driving behavior, vehicle performance, and maintenance needs. This data can be used to adjust premiums based on actual usage and driving patterns.

Innovations in Tech Integration for Electric Vehicle Insurance

- Usage-Based Insurance Models: Insurers may shift towards usage-based insurance models that offer more flexibility and cost savings for electric vehicle owners. This can incentivize safer driving practices and promote eco-friendly behavior.

- Smart Contracts: Smart contracts powered by blockchain technology can automate insurance processes, such as policy issuance, claims settlement, and premium payments. This can reduce administrative costs and streamline the overall insurance experience.

- Predictive Analytics: By leveraging predictive analytics, insurers can anticipate potential risks and tailor insurance coverage to mitigate those risks proactively. This can result in more accurate pricing and enhanced coverage options for electric vehicle owners.

Collaboration Between Electric Vehicle Manufacturers and Insurance Companies

- Product Bundling: Electric vehicle manufacturers are exploring partnerships with insurance companies to offer bundled insurance packages with new vehicle purchases. This can simplify the insurance buying process for consumers and provide comprehensive coverage from the start.

- Telematics Integration: Some electric vehicle manufacturers are integrating telematics systems directly into their vehicles to capture data on driving behavior and vehicle performance. This data can be shared with insurance companies to offer usage-based insurance and personalized coverage options.

- Risk Assessment Tools: Collaborations between electric vehicle manufacturers and insurers can lead to the development of advanced risk assessment tools that factor in vehicle-specific characteristics and safety features. This can result in more accurate underwriting and tailored insurance solutions for electric vehicle owners.

Ending Remarks

In conclusion, Electric vehicle insurance and tech integration are paving the way for a more streamlined and efficient insurance process. Embracing technology in the insurance sector not only benefits insurers but also enhances the overall experience for electric vehicle owners.

Stay informed and prepared for the future of electric vehicle insurance and tech integration.

Question Bank

What are some key factors that influence electric vehicle insurance rates?

Factors such as the vehicle's make and model, driving history, location, and coverage options can all impact electric vehicle insurance rates.

How is technology integrated into electric vehicle insurance policies?

Technology is integrated through telematics devices for monitoring driving behavior, risk assessment tools, and streamlined claims processing systems.

What role do telematics devices play in determining insurance premiums for electric vehicles?

Telematics devices track driving habits and provide insurers with data to assess risk, potentially leading to personalized insurance premiums based on individual driving behavior.

How are electric vehicle manufacturers collaborating with insurance companies to enhance coverage options?

Manufacturers are working with insurers to develop specialized insurance packages that cater to the unique needs of electric vehicle owners, offering comprehensive coverage and innovative solutions.